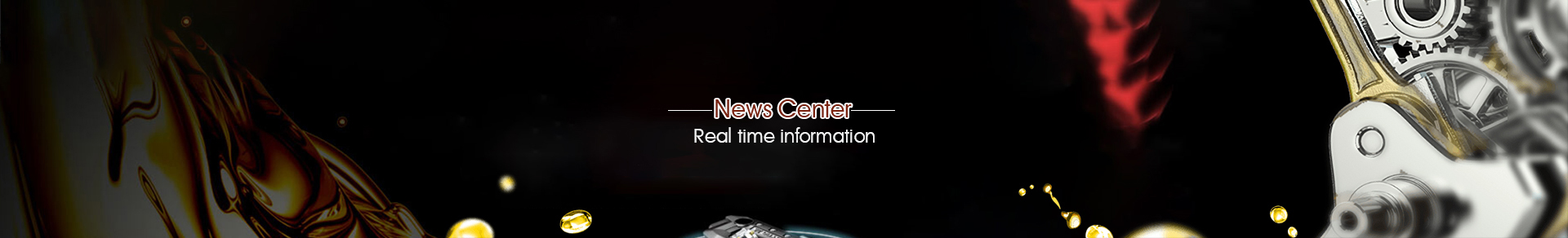

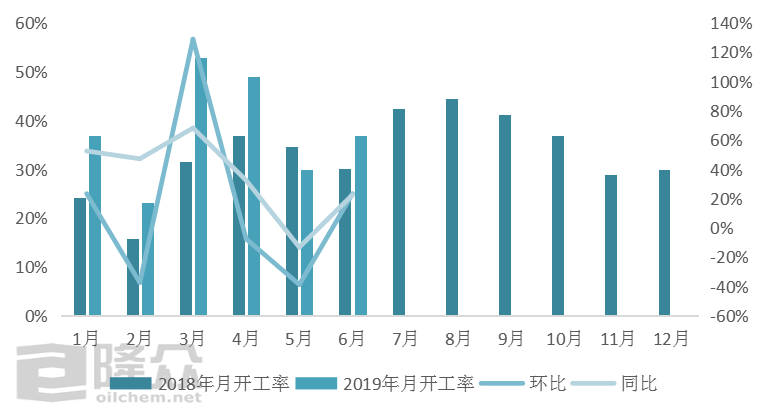

Fig. 1 Comparison Chart of domestic reclaimed oil market starts

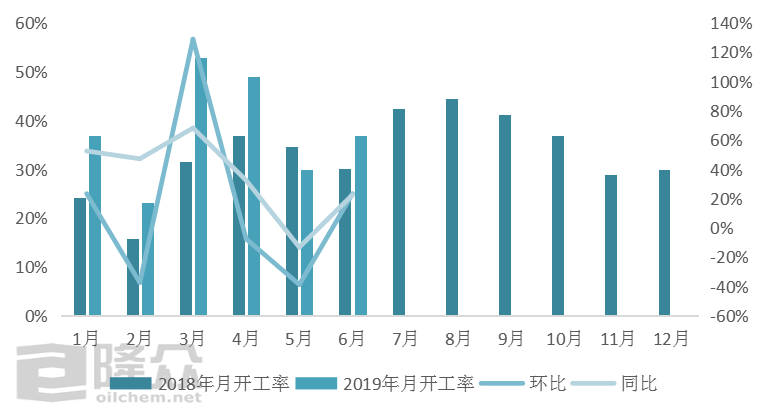

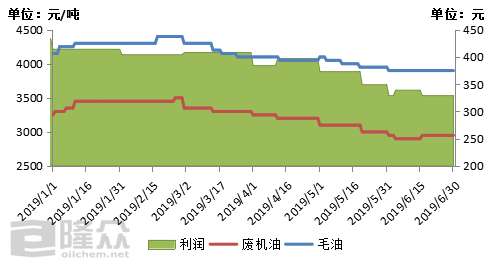

Fig. 2 raw material cost and profit trend chart of reclaimed oil

Long data show that Two thousand and nineteen Profit in the first half of 2014 Regenerated oil Break down, maintain current profits 280-340 element / Tons, or a year-on-year decline, is relatively obvious. That is why the overall market operating rate is low. 30% Shake and float. In the same month, crude oil prices kept stable, and high viscosity resources were flat or lower than low viscosity resources due to poor shipment. Recently, supported by the international crude oil, the price of gasoline and diesel has increased slightly, and the price of raw materials has been fluctuated.

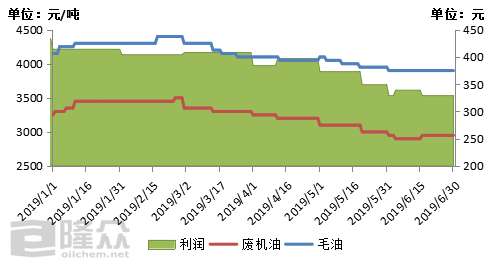

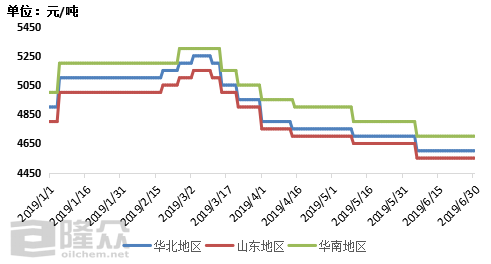

Fig. 3 domestic regenerated oil 150SN The price chart

Long data show that Two thousand and nineteen In the first half of the year, the price of regenerated oil showed a trend of "several", and the average price declined significantly compared with the same period last year. One , Two Renewable oil prices continue to explore in April. Three Since mid June, the trend of concussion has declined, and the price has reached a new low for two years. This is mainly affected by the downturn in terminal demand, coupled with the increase in government environmental protection. Six Since mid January, raw material prices have begun to rebound, driven by rising sentiment and passive replenishment from downstream users. Under the current traditional sales season, the regene