After the closing of the two session of the thirteen National People's Congress on the morning of March 15th, the premier of the State Council met with Chinese and foreign journalists at the Golden Hall of the third floor of the Great Hall of the people to interview the two session of the thirteen National People's Congress and answered questions raised by reporters.

I want to ask questions about tax reduction and tax reduction. The Chinese government has introduced a series of measures to reduce taxes and reduce taxes. Many entrepreneurs have reflected that the tax revenue of enterprises is still heavy. This year the government has introduced a more massive tax reduction and reduction. Do you think companies can get tangible benefits? Is finance sustainable?

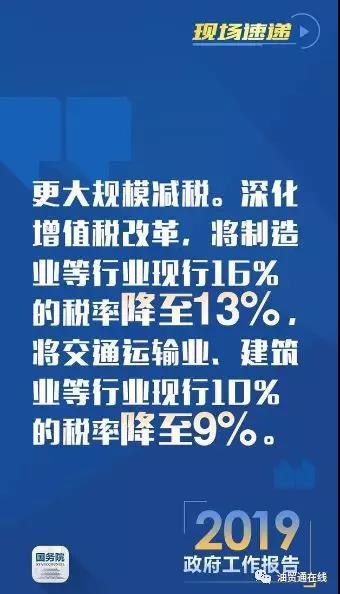

In recent years, we have made use of carriers such as battalion changing and increasing, on average, we have reduced taxes to one trillion yuan for enterprises, and three trillion yuan for three years.It should be said that the scale of our tax cuts is relatively large. This year, we are determined to carry out a larger tax reduction. The value added tax and the unit social security payment rate will be reduced, and the dividends of tax reduction and reduction will be close to two trillion yuan. This can be said to be a very important key measure to deal with the downward pressure on the current economy.

This is conducive to equity, because enterprises in accordance with the rules can generally benefit from tax reduction fees, and the policy efficiency is very high. The value added tax will be reduced in April 1st, and the rate of social security will be lowered in May 1st. I think there is no other way to give the company more equitable and effective feelings than this way.

Just now, the reporter asked, is it sustainable to do this? We also calculate the bill carefully. We are obviously giving tax cuts to the basic industries such as manufacturing and the largest SMEs in the area of employment. This is actually a "fish culture" and a financial source. In the past few years, we started to reduce revenue in the process of business transformation, but then the tax base expanded and revenue grew. Now we have to adjust the distribution structure of national income, which is also a reform. From the trend, we should give profits to the real economy and enterprises, so that they can have more proportion in the cake of national income distribution, so that more employment can be promoted, and the income of the employment population will be increased. To this end, the government will have to tighten up the day and make profits. The stock interests of the government must also be moved. Offending people should also move, so that they will be beneficial to the enterprises and benefit the people, so that the finance will be more sustainable. We do this not to say that in anticipating the future, we are nurturing the future.

Now, what do we need to pay attention to?

Before and after the VAT rate adjustment, it is necessary to select the applicable tax rate accurately and issue invoices.

According to the relevant provisions of the current value-added tax, the tax rate applicable to taxpayers shall be determined on the basis of the time of tax payment. Therefore, the taxpayers' duty to generate taxable selling behavior occurs before the tax rate is adjusted, and the invoices should be invoiced according to the original applicable tax rate (16% or 10%). When taxpayers' duty of taxable sale occurs after the tax rate is adjusted, the invoice can be invoiced in accordance with the adjusted tax rate. Article source network - Oil Trade Online